Last year the Bureau of Meteorology declared that Australia would be entering into a La Nina weather pattern over the coming few years.

Already there has been evidence of this weather phenomenon at play with significant rainfall experienced in New South Wales during March of this year, with some areas of Sydney and the Hunter Valley receiving between 400mm and 600mm of rain.

As we enter the notoriously volatile Australian storm season again, it is a timely reminder to revisit how your organisation can prepare for, respond to and recover from a significant weather event.

Now is the time to take preventative action to protect your property and ensure that your church and ministry insurance is up to date.

Weathering the storm

Australia’s weather can be unpredictable at the best of times often resulting in extreme weather events.

November to March are traditionally our most volatile months with respect to severe weather activity.

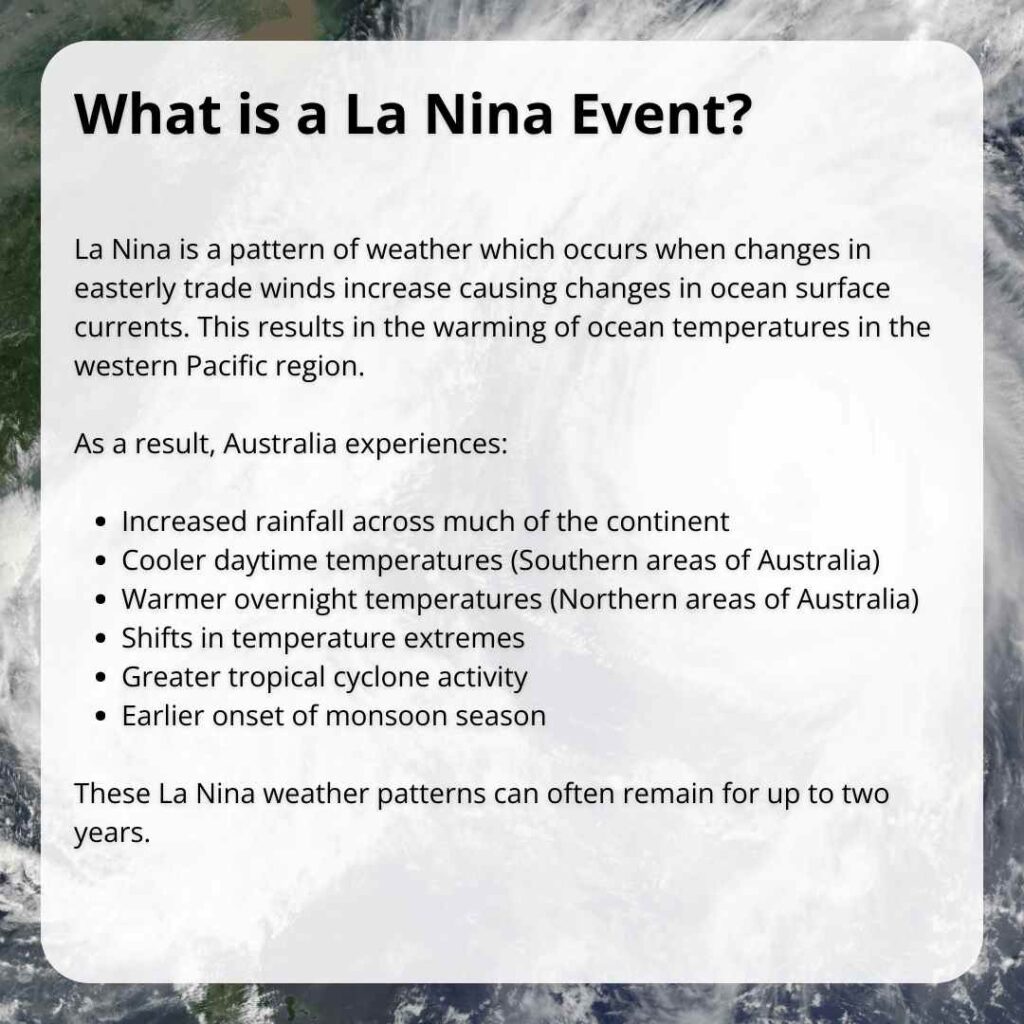

In addition, Australia’s Bureau of Meteorology have officially declared that 2020-2021 and in to 2022 will be affected by a La Nina weather event which will further compound our nations fickle weather patterns.

As such, now is the time to consider how you will prepare for the inevitable severe weather events which seem to go hand in hand with an Australian summer.

The last time we saw a prolonged La Nina weather pattern such as this was the 2010-2012 period which resulted in one of our wettest two-year periods on record and widespread damage caused by significant flooding along the east coast of Australia and five severe category tropical cyclones, including Cyclone Yasi.

2011 experienced some of the most devastating weather events including:

January 10 2011 – Following 36 hours of torrential rain, a flood surged through Toowoomba and towns in the surrounding Lockyer Valley, killing 22 people and leaving a path of devastation in its wake.

January 11 2011 – Only a day later, the Brisbane River broke its banks crippling the Brisbane CBD infrastructure and causing damage to over 6000 homes and businesses in the area.

January 12-14 2011 – Areas of Victoria, northern Tasmania and southern NSW are again battered by heavy rain and severe thunderstorms. Over 50 communities in Central and Western Victoria are flooded and two lives lost. Many towns experienced their second flood in only four months.

February 3 2011 – Cyclone Yasi makes landfall near Mission Beach with winds in excess of 285km p/h. With damage estimated at over $3.5 billion, Cyclone Yasi was the country’s 10th largest catastrophe event on record.

February 4-6 2011 – Suburbs of Melbourne are lashed by severe storms resulting in flash flooding, roofs being ripped from buildings and trees uprooted. Insurers receive more than 50,000 claims totalling more than $410 million.

February 5 -7 2011 – whilst the East Cost of Australia was being battered by storms and cyclones, bushfires devastated areas of Perth destroying 71 properties, damaging 39 others and causing over $35 million in damage.

Christmas Day 2011 – Fierce storms ripped across Melbourne’s suburbs. Hail, wind and rain damaged thousands of homes and businesses, and damaged or destroyed tens of thousands of vehicles.

Is your organisation prepared for floods, storms, or fire?

Understanding your organisation’s risks, preparing and planning for adverse events, identifying your trigger points and having a clear recovery plan will go a long way to protecting your property and aiding a swift return to your programs.

Step 1 – Understand your risk

- Is your property situated on a flood plain, near a water course or in a cyclone prone area?

- Has your area been subject to flooding previously?

- Would this result in damage to your property or contents?

- How would it effect your operations?

- Does your insurance cover you for flood damage?

- Does your policy cover you for business interruption costs after a loss?

- What impact would it have on staff?

- Are data systems or church records at risk?

Step 2 – Preparing and Planning (before a weather event happens)

- Have you developed an emergency action plan?

- Do you have a business continuity plan?

- Are your computer systems protected and backed up?

- Are staff trained in implementing your plans?

- Is your insurance adequate and up to date?

- Do you have an emergency contact list?

- Has your property been maintained to minimise the impact of a claim?

Step 3 – Responding (a weather event is imminent)

- Have you downloaded weather/warning apps?

- Are additional resources able to be accessed to protect your property?

- Do you have access to sandbags, water pumps, hoarding, and alternate storage locations?

- Are key electronic records securely stored offsite?

- Do you have a clearly documented communication chain?

- Are hazardous materials safely stored or able to be removed from site?

Step 4 – Recovery (after a significant weather event)

- Have you implemented your business continuity plan?

- Can you communicate your recovery plans with your members?

- Contact your Insurance Broker or Insurer to notify of a claim

- Continue to stay informed of ongoing situation

- Follow local authority advice

- Review your flood and storm plan and update if necessary

The Australian Government’s business.gov.au website is an excellent resource for preparing your emergency management plans. It provides helpful downloadable documents including:

- What is an emergency management plan and how to prepare one

- What to do in an emergency

- Preparing your continuity plan

- Preparing your recovery plan

https://www.business.gov.au/risk-management/emergency-management

Tips for preparing your property for storm, flood, fire or cyclone

Extreme weather events cannot be avoided, however, how we prepare for them can certainly minimise their impact on our properties and activities. A robust property maintenance program is key to reducing potential damage to your assets and assisting in the recovery process.

- Ensuring roofs, gutters and storm water drains are well maintained and clear of debris

- Removing or securing outdoor equipment (shade sails, furniture, play equipment, bins)

- Cutting back overhanging trees

- Relocating valuable equipment or contents to an alternative/safe location

- Lift equipment above potential floodwater levels

- Turning off electricity and gas to property at main switches if event expected

- Fitting glass windows and doors with storm shutters or hoarding

- Installing security mesh or robust, well fitted insect screens on windows

- Protecting skylights with mesh screens

- Reinforcing roller doors to withstand strong winds

- Ensuring that flammable materials are stored safely and not closed to buildings

- Cutting long grass and overgrown foliage around properties in fire prone areas

- Installing quality surge protection and uninterruptible power supply (UPS) devices

- Documenting your assets

Whilst copies of receipts and instruction manuals are great for identifying your assets, if these are not available a video record of your equipment can be equally as helpful. Use your smart phone to video or photograph your equipment for a quick and easy asset register.

If possible flooding, sandbag perimeter of your building to reduce ingress of flood water. Place sandbags in toilet bowls and over floor wastes and drains to prevent the backflow of sewerage and grey water into the premises.

How you can help us, help you

Here at ACS Insurance Services, we have developed and sourced church and ministry insurance and protection products to protect your property and your ministry against a multitude to situations. Packages can provide cover against flood, cyclone and other extreme weather events, as well as business interruption costs you may suffer after a loss.

Our staff have years of experience in assisting our clients navigate the claims process and can provide access to panels of qualified loss adjusters and repairers to set you on the path to recovery as quickly as possible.

However, there are many things that you can do which will assist and expedite the processing of a claim after a significant loss:

- Ensure that your Insurance and Protection Package is up to date

- Regularly check that building and contents values represent the true replacement value

- Following a significant weather event check on your property as soon as it is safe to do so

- Report any loss or damage to your insurer as soon as possible

- Temporarily secure or tarp damaged property to protect from further damage

- Document and photograph damage

- Begin seeking quotations for the repair or replacement of damaged equipment

- Always co-operate with local authorities and adhere to their safety messages

In the case of water ingress, if safe and practical to do so, begin process of drying out carpets and plaster and removing water damaged contents (do not dispose of items without first consulting with your insurer).

Peace of mind is just a phone call away. Call ACS Financial to discuss how our dedicated Church Insurance and Protection products can protect your assets.

Other Helpful Links and Resources:

www.ses.vic.gov.au – Victoria State Emergency Service

https://www.emergency.vic.gov.au/respond/ – Vic Emergency

www.ses.nsw.gov.au – New South Wales State Emergency Service

www.ses.sa.gov.au – South Australia State Emergency Service

www.ses.qld.gov.au – Queensland State Emergency Service

www.dfes.wa.gov.au – Western Australia Department of Fire and Emergency Services

www.ses.tas.gov.au – Tasmania State Emergency Service

www.securent.nt.gov.au – Northern Territory Government – Prepare For An Emergency

www.bom.gov.au – Bureau of Meteorology

www.redcross.org.au/prepare – Australian Red Cross -Emergency Preparedness Guide

DISCLAIMER: The information on this website reflect some of the commercial aspects and potential risks/obligations for your Church, School or Organisation. The information is given as a guide only and does not represent a definitive list or legal view in any way shape or form. You are advised to seek your own professional advice on all your individual needs. ACS Financial Pty Ltd (ACN 062 448 122) (AFSL 247388).