Underinsurance and the cost of getting your property values wrong

Purchasing a building for your church is often the culmination of many years of faithful vision and stewardship of your leadership and members. Protecting your investment is paramount. Underinsurance is a considerable risk for all churches that own property. With the prevalence of underinsurance, what can you do to ensure the protection of your church property for the correct value?

What is underinsurance?

Underinsurance refers to failing to insure your property for the total amount needed to repair or replace it. People frequently believe that if they underinsure their property, they will save money on their premiums. Whilst that may be the case, saving a few dollars on your premium may cost you dearly and leave you with no money in the case of a claim.

Why would you be out of pocket?

Suppose you have not adequately declared the replacement value of your property, and a loss occurs. In that case, you may be required to make a proportionate contribution towards your claim. This is referred to as the Average Clause or the Co-Insurance Clause.

Most providers will allow a percentage of tolerance on declared values. An acceptable tolerance is typically 15%. Therefore you should ensure that your values are within at least 85% of their correct margins. In the example below, a church has nominated a sum insured, representing only half of its replacement value. In the instance of a partial loss of $200,000, and considering the 85% allowance, you can see that the church will still be over $83,000 out of pocket.

Average / Co-insurance Example | |

|---|---|

Declared Value / Sum Insured | $500 000 |

Estimated Actual Value | $1,000,000 |

Average / Co-Insured Percentage | 85% |

Loss | $200,000 |

Claim payment = $117,647 (less excess payment) | |

What is the biggest mistake people make?

Could your property be underinsured?

Statistics gathered from our 2020-2021 Church Property portfolio found that over 80% of properties protected had not had their values amended by the owners from the previous year.

In a recent sample of properties that ACS Financial submitted to an independent valuing company for review, nearly all valuations indicated substantial underinsurance.

In December 2022, statistics gathered by the Insurance Council of Australia showed that more than 80% of Australians have underinsured properties.

Why are so many properties underinsured?

Many people allow their property insurance to roll over each year. The renewal notice arrives, and the bill gets paid. Many people don’t think they need to do anything else. Many insurers will apply a percentage increase on the value of your property each year. However, this does not remove the need for the property owner to take stock of the correct value of their assets and ensure that it is appropriately valued.

A structure that is 20 years old will cost substantially more to rebuild today due to the rising cost of construction materials and other related expenditures. These costs may increase due to the high demand for suppliers during disasters like floods or bushfires.

Over time, you could find yourself with inadequate insurance without realising it. The value of your assets may dramatically increase if you have renovated or altered your property. Additionally, churches frequently upgrade and replace equipment and contents with higher-end, more expensive items without changing their insurance coverage.

How to avoid underinsurance

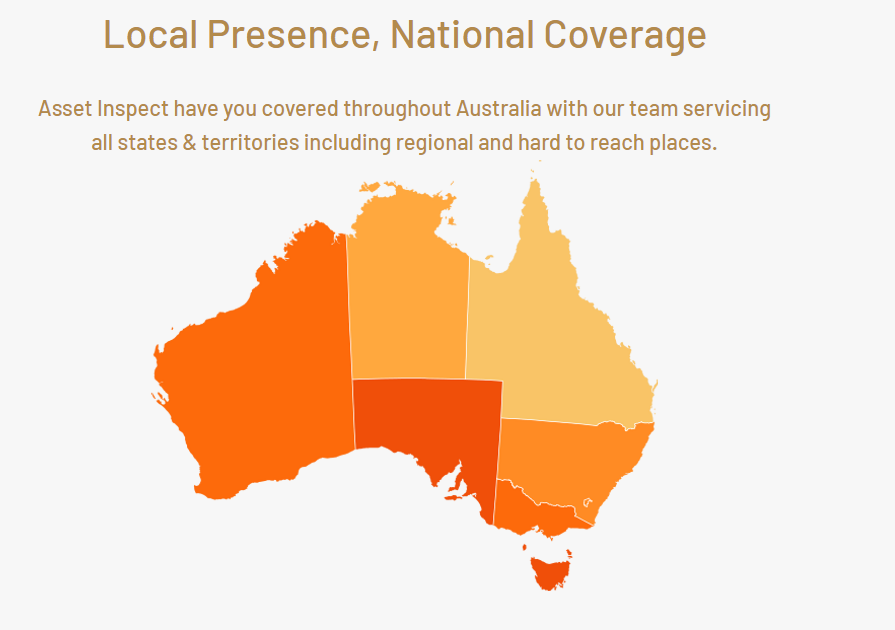

You must regularly review the amount you have insured your property for. Whilst many insurers provide online building and contents valuation calculators for domestic properties, commercial or purpose-built properties require a higher degree of expertise. In recent years, Covid supply chain issues and significant strain on the building industry following an unprecedented storm and flood season in Australia have significantly impacted building costs. As such, an expert commercial property valuation firm is your best option to access the most accurate information and replacement value of your property.

Your insurance broker or advisor should be able to direct you to professional valuation services that can provide you with the right advice.

ACS Financial

ACS Financial has served over 3000 churches, ministries, Christian schools, SMEs, NFPs and individuals for nearly 30 years. Over this time, we’ve been refining and developing comprehensive church insurance and protection packages tailored to your unique needs.

Our comprehensive church Insurance and Protection packages let you run an effective ministry with peace of mind even if accidents happen or things go wrong.

We understand the risks and costs involved in administering a church and ministry. ACS Financial will provide you with competitive church insurance and protection packages tailored to the level of coverage you need.

We know that no two churches are the same. Our experienced team of church insurance professionals explain the products available to help you select the best cover for your church or ministry based on your unique needs.

Our process is quick and easy. Our friendly team are here to support you every step of the way.

For more information, contact us at 1800 646 777 or visit our website at www.acsfinancial.com.au

DISCLAIMER: The information on this website reflect some of the commercial aspects and potential risks/obligations for your Church, School or Organisation. The information is given as a guide only and does not represent a definitive list or legal view in any way shape or form. You are advised to seek your own professional advice on all your individual needs. ACS Financial Pty Ltd (ACN 062 448 122) (AFSL 247388).